스포트라이트

Accounting Clerk, Accounts Payable/Receivable Clerk, Bookkeeping Assistant, Financial Assistant, Finance Clerk, Accounts Assistant, Payroll Assistant, Billing Clerk, Financial Operations Assistant, Junior Accountant, Bookkeeping Clerk, Accounts Receivable Clerk, Accounting Technician

Every business, school, and organization depends on one thing to keep running smoothly—money management. But who keeps track of all those payments, invoices, and financial records behind the scenes? That’s where Accounting Assistants come in!

Accounting Assistants help maintain accurate financial records that keep companies organized and compliant. They record daily transactions, process bills and payments, check bank statements, and make sure everything adds up perfectly. Think of them as the backbone of a company’s financial team—the people who make sure the books stay balanced and the bills get paid on time.

Their work goes far beyond crunching numbers! They collaborate with accountants, managers, and sometimes even clients to verify data, prepare reports, and solve small financial mysteries—like finding out why a payment didn’t go through or where an extra charge came from.

Whether it’s tracking expenses for a local café or assisting auditors at a large corporation, Accounting Assistants play a vital role in helping businesses make smart financial decisions. It’s a great career for those who love numbers, organization, and the satisfaction of keeping everything in perfect order.

- Seeing the financial picture of a company clearly because of your careful recordkeeping.

- Playing a key role in keeping a business running smoothly and efficiently.

- Gaining versatile experience that can lead to higher-level accounting or finance positions.

- Developing technical and analytical skills that are valuable in nearly every industry.

- Feeling satisfaction when reports balance perfectly after hours of careful review.

근무 일정

Accounting Assistants typically work full-time during regular business hours, Monday through Friday. During tax season, fiscal year-end, or audit periods, overtime may be required. Remote and hybrid work options are increasingly common in this field.

일반적인 의무

- Enter and verify financial data into accounting software.

- Prepare invoices, purchase orders, and expense reports.

- Process payments, deposits, and reimbursements.

- Reconcile bank accounts and financial statements.

- Support payroll processing and tax documentation.

- Assist accountants with monthly or quarterly financial reports.

추가 책임

- Maintain organized digital and paper filing systems.

- Communicate with vendors and clients about billing issues.

- Help track budgets, expenses, and petty cash.

- Support internal audits by locating records and verifying transactions.

- Update spreadsheets and assist in preparing year-end statements.

- Ensure compliance with company policies and accounting regulations.

A typical day starts with reviewing emails and checking for new invoices or expense submissions. Many Accounting Assistants begin by entering data from receipts or purchase orders into accounting software.

Midmorning might include reconciling yesterday’s transactions, verifying payments, and ensuring all documents match the correct accounts. The afternoon is often spent preparing spreadsheets, processing reimbursements, or assisting an accountant with month-end reports.

During busy periods—like tax season—days can be more fast-paced, involving cross-checking financial statements and working closely with auditors.

“Our corporate support staff work day in and day out, behind the scenes, supporting our on-site teams, planning our growth, charting our success and so much more.” — Nyssa Garrison, Accounting Assistant, PLK Communities.

소프트 스킬

- 세부 사항에주의

- 시간 관리

- 조직

- 무결성 및 기밀성

- 분석적 사고

- 의사소통 기술

- 신뢰성

- 문제 해결

- 팀워크

- 고객 서비스

기술 능력

- Accounting software (e.g., QuickBooks, SAP, Xero)

- Microsoft Excel and Google Sheets

- Data entry and database management

- Accounts payable/receivable systems

- Payroll and billing procedures

- Bookkeeping principles

- Financial report preparation

- Spreadsheet formulas and pivot tables

- Budget tracking

- Knowledge of GAAP (Generally Accepted Accounting Principles)

- Accounts Payable Assistants: Handle vendor invoices and outgoing payments.

- Accounts Receivable Assistants: Track incoming payments and manage client billing.

- Payroll Assistants: Help process employee wages and benefits.

- Audit or Compliance Assistants: Support internal and external audit processes.

- Bookkeeping Assistants: Handle general ledgers and reconcile financial records for small businesses.

- Accounting firms and audit agencies

- Corporate finance departments

- Government offices

- 비영리 단체

- Healthcare and educational institutions

- Small businesses and start-ups

Accuracy and deadlines rule the day. Accounting Assistants are expected to be meticulous—even when handling repetitive tasks—and to maintain confidentiality about financial information. Month-end closings or tax season can mean longer hours and extra focus.

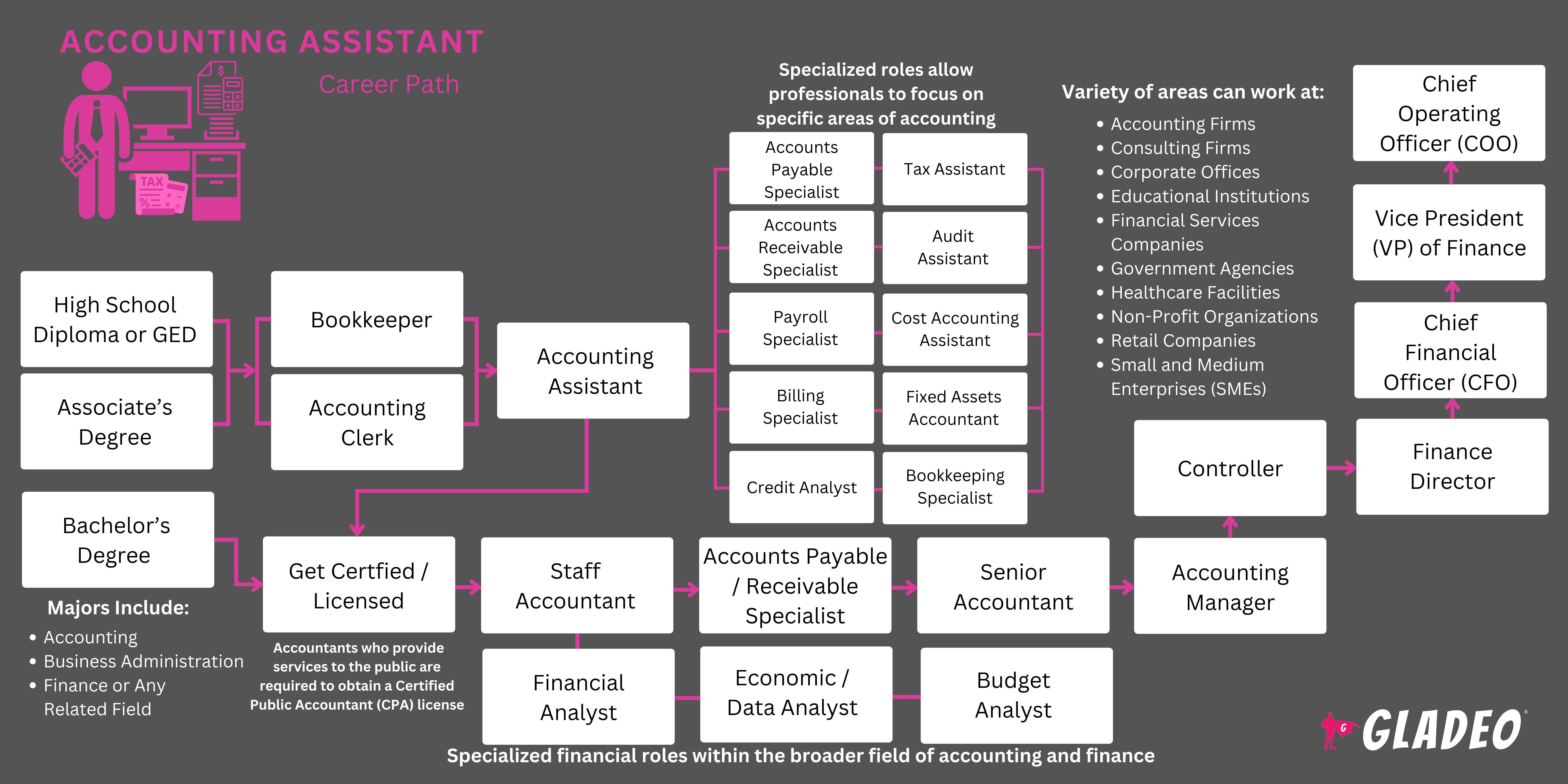

However, the payoff is learning directly from accountants, gaining real-world financial experience, and building a foundation that can lead to roles like Staff Accountant or Financial Analyst.

Automation and digitalization are transforming accounting. Cloud-based systems, AI-driven data entry, and e-invoicing are becoming standard. Still, human oversight remains essential for accuracy and ethical judgment. Sustainability reporting and ESG (Environmental, Social, and Governance) tracking are also adding new dimensions to accounting work.

Remote work has opened opportunities to assist accounting departments anywhere in the world.

People who go on to become Accounting Assistants often enjoyed activities that involved organization, numbers, and attention to detail. They may have liked keeping track of their own spending or helping family members budget. Many found satisfaction in math-related schoolwork, puzzles, or logic games. Some might have enjoyed organizing school events, helping teachers record grades, or working part-time in offices where they could use spreadsheets or handle receipts. They tend to take pride in accuracy, enjoy seeing things “add up,” and like bringing order to financial or organizational chaos.

고등학교 졸업장 또는 검정고시(최소 요건)

- Focus on math, business, and computer classes. Courses in economics or accounting (if offered) are great preparation.

Postsecondary Certificate or Associate Degree (Preferred)

Most employers prefer a 2-year degree in:

- 회계

- Business Administration

- Finance

- Bookkeeping

Bachelor’s Degree (Advancement)

A 4-year accounting or finance degree can open doors to higher positions such as Staff Accountant or Auditor.

Certifications That Can Help You Stand Out:

- Certified Bookkeeper (CB) – American Institute of Professional Bookkeepers

- QuickBooks Certified User

- Microsoft Office Specialist (Excel)

- Payroll Certification (Fundamental Payroll Certification – APA)

- In high school, focus on math, business, accounting, and computer courses

- Strengthen your problem-solving and communication skills—these are key in any finance role

- Practice using spreadsheet programs like Microsoft Excel or Google Sheets

- Join business or entrepreneurship clubs such as DECA or Junior Achievement

- Volunteer as a treasurer for a school club or community organization to gain hands-on budgeting experience

- Apply for part-time or summer jobs in offices, retail, or small businesses to learn about handling payments and receipts

- Attend workshops or webinars on basic accounting, bookkeeping, or financial literacy

- In college, pursue an associate or bachelor’s degree in Accounting, Business Administration, or Finance

- Take courses in payroll, taxation, and financial reporting to build technical knowledge

- Look for internships or cooperative education programs in accounting firms or finance departments

- Seek scholarships offered by accounting organizations such as the American Institute of Professional Bookkeepers (AIPB) or state CPA societies

- Learn to use accounting software like QuickBooks, Xero, or SAP—skills that employers highly value

- Take ethics or business law courses to understand financial regulations and compliance

- Join student accounting associations or professional groups like the AIPB or Institute of Management Accountants (IMA) to build your network early

Look for schools that offer:

- Hands-on accounting software training (QuickBooks, Excel, SAP)

- Internship or co-op opportunities with local businesses

- Coursework in payroll, taxation, and financial reporting

- Small class sizes and mentorship opportunities

다음과 같은 훌륭한 프로그램이 있습니다:

- Portland Community College – Accounting Certificate Program

- City College of San Francisco – Accounting AS Degree

- Penn Foster College – Online Accounting Associate Degree

- University of Phoenix – Bachelor’s in Accounting

- Search for entry-level openings on Indeed, LinkedIn, Glassdoor, or local business job boards.

- Use keywords like Accounting Clerk, Bookkeeping Assistant, or Accounts Payable Specialist.

- Highlight any coursework in accounting, computer skills, or internships on your résumé.

- Apply to roles in industries like retail, healthcare, or nonprofits—almost every organization needs accounting support.

- Ask professors or internship supervisors for references—they can vouch for your reliability and accuracy.

- Learn to use accounting software and bring that up in interviews—it’s a huge advantage.

- Dress professionally and emphasize your attention to detail and organization skills.

- Volunteer to help with bookkeeping or budgeting for student clubs, community groups, or small businesses—experience counts even if it’s unpaid.

- Join a local or online accounting association or young professionals group to build your network.

- Prepare for common interview questions like “How do you stay organized?” or “Describe a time you caught an error before it became a problem.”

- Tailor your résumé to each job—use keywords from the job posting so applicant tracking systems (ATS) pick it up.

- Take free or low-cost online courses in Excel, QuickBooks, or Microsoft Dynamics to boost your skills.

- Show enthusiasm for learning and growth—employers value candidates who are eager to advance.

- Follow up after submitting an application or interview to show professionalism and interest.

- Gain experience and take on more responsibility with account reconciliation or report preparation.

- Earn a Certified Bookkeeper or QuickBooks ProAdvisor credential.

- Continue your education to earn a bachelor’s degree in accounting or finance.

- Network through the American Institute of Professional Bookkeepers (AIPB) or local business associations.

- Move into roles such as Staff Accountant, Financial Analyst, or Accounting Manager as you build experience.

- Volunteer for special projects or audits that expose you to higher-level financial processes.

- Master advanced Excel functions and data analysis tools—these are highly valued by employers.

- Learn to prepare financial statements and understand regulatory compliance to expand your expertise.

- Develop your communication and teamwork skills—you’ll often collaborate with managers, vendors, and other departments.

- Ask to cross-train in payroll, budgeting, or accounts receivable/payable to broaden your experience.

- Seek mentorship from senior accountants or controllers to learn the ropes of strategic finance.

- Stay updated on tax laws and accounting software trends to remain competitive.

- Consider earning professional certifications such as CPA (Certified Public Accountant) or CMA (Certified Management Accountant) if you plan to advance into senior accounting or financial management.

- Demonstrate reliability and initiative—being known as the “go-to person” for accuracy and problem-solving can open promotion opportunities.

- After several years, explore advancement into Controller, Accounting Supervisor, or Finance Director roles depending on your career interests.

웹사이트

- American Institute of Professional Bookkeepers (AIPB)

AccountingCoach.com - U.S. Bureau of Labor Statistics – Accounting and Bookkeeping

- QuickBooks.com Learning Center

- Indeed Career Guide – Accounting Jobs

- LinkedIn Learning – Excel and Bookkeeping Courses

책

- Bookkeeping All-in-One For Dummies by Lita Epstein

- Accounting Made Simple by Mike Piper

- QuickBooks Online for Beginners by Crystalynn Shelton

Accounting Assistants are essential to every organization’s financial operations—but the job can sometimes be repetitive and deadline-driven. Month-end closings, audits, and tax seasons can bring extra pressure and long hours. Still, the attention to detail and problem-solving skills you gain are valuable across many industries.

If you’re interested in similar careers that use the same strengths in organization, accuracy, and financial management, consider the options below!

- Payroll Specialist

- 행정 보조원

- Billing Clerk

- Financial Data Entry Clerk

- 사무실 관리자

- Tax Preparer

뉴스 피드

주요 채용 정보

온라인 과정 및 도구